Faced with huge rent rises, longstanding dealers are leaving the street while the London Diamond Bourse are considering their long-term future in Holborn.

Victoria McKay, chief operating officer of Bourse – the trading floor for precious stones – has warned that the facility could move from their historic home at 100 Hatton Garden when the lease expires in three years’ time.

An extraordinary general meeting is planned for November 3 where more than 300 members have the chance to discuss their future. The options will be to stay put at a much-increased rent or look for a new location elsewhere in London.

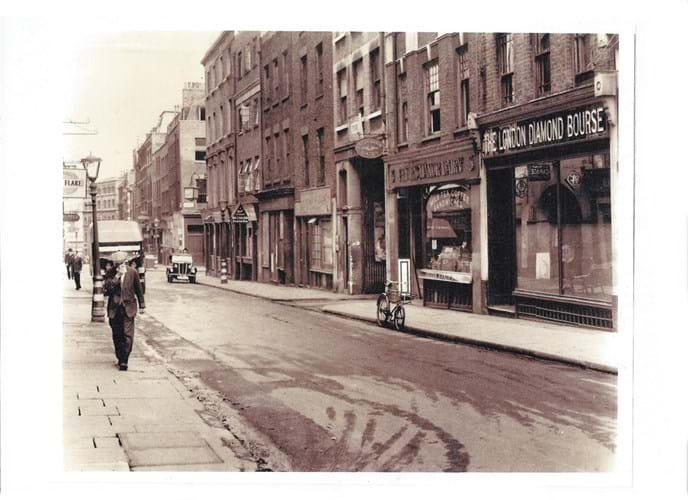

Hatton Garden and the London Diamond Bourse in its pre-war guise. Image courtesy of London Diamond Bourse.

“We are not ruling out staying here,” McKay told ATG. “But we have made no secret of the fact that our lease ends in July 2019. It is imperative that we make plans beyond that date. Once we have held our EGM, we plan to be as transparent as possible and keep the rest of the industry informed of our position.”

Rents in the area are doubling as landlords and developers prepare for a boost in occupancy expected when Crossrail reaches Farringdon in 2018.

This area, the centre of London’s jewellery trade since medieval times, is now increasingly viewed as prime office and residential space.

Workshops Given Notice

McKay is among those who believe rent rises risk breaking up “a family cluster of specialists”. Of particular concern is the future of the workshops and small businesses that operate, largely unseen, above ground floor level. “It’s not a case of a mass exodus yet, but workshops have been given notice and other leases are not being renewed. We are a family and if we become fragmented it is a problem.”

Craftsmen and small dealerships that have plied their trade at London’s Hatton Garden for decades are now threatened by rent increases. Image courtesy of London Diamond Bourse.

Among those leaving the Garden are jewellery, silver and objets d’art dealers Landsberg & Son. Their building, 26-27 Hatton Garden, is to be redeveloped into office space with the tenants told to leave. At the end of October Landsberg will move to New Bond Street.

James Dallas of Landsberg told ATG the firm has been in Hatton Garden since the 1920s. He conceded that, with the influx of retailers of homogeneous modern jewellery and the exodus of dealers and wholesalers, the character of the street had changed markedly in the past decade. “My grandfather and my uncles would not recognise the place,” he said.

Despite the uncertainty over the jewellery quarter’s future, the businesses of Hatton Garden voted in July to establish a Business Improvement District (BID) to revamp the area. Some 79% of businesses (representing 83% by rateable value) endorsed a £2.5m investment plan designed to enhance the currently tired-looking London jewellery quarter.

The five-year programme includes new street furniture, improved signage and a marketing campaign.

The BID will be funded by a small levy on business rates (1%) and voluntary contributions will also be sought from property owners.

McKay is backing the BID but concedes that “the one thing it can’t do is anything about commercial rents”.