It announced a strategic review which could lead to a sale of the company and has hired City investment firm finnCap to perform the review.

The announcement follows a series of disposals by the stamps group in recent weeks as it pays off debt.

Last month it announced it had agreed a deal with former auctioneer and ceramics specialist Mark Law and investor Gavin Alexander to sell auctioneer Dreweatts and dealer Mallett for £2.4m.

It also agreed to sell its 25% stake in Masterpiece London for £1.4m to the majority owner of the art and antiques fair. Stanley Gibbons' chairman Harry Wilson, who joined in May 2016, is leading the effort to sell off businesses to pay down debt.

'Much more stable'

In a statement today the company said its "restructuring program has created a group that is now much more stable than at any time in the last 18 months".

On Friday, private equity firm Disruptive Capital was reported to have been in discussions with the company but today said it is not making an offer.

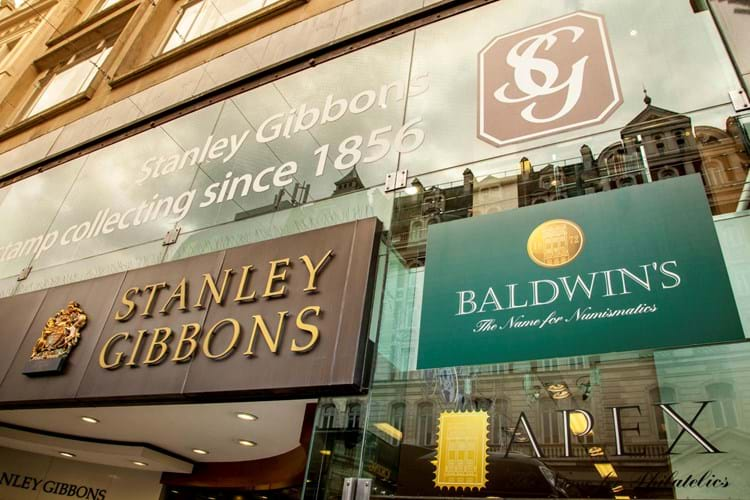

The core activities of the Stanley Gibbons group are now its coin and stamp businesses Baldwin's, Stanley Gibbons, Murray Payne and Apex, but also book auction firm Bloomsbury.

In the past 18 months the company has issued a series of profit warnings.