Phoenix UK Fund has bought a 58% stake and taken on the company’s debt from Royal Bank of Scotland.

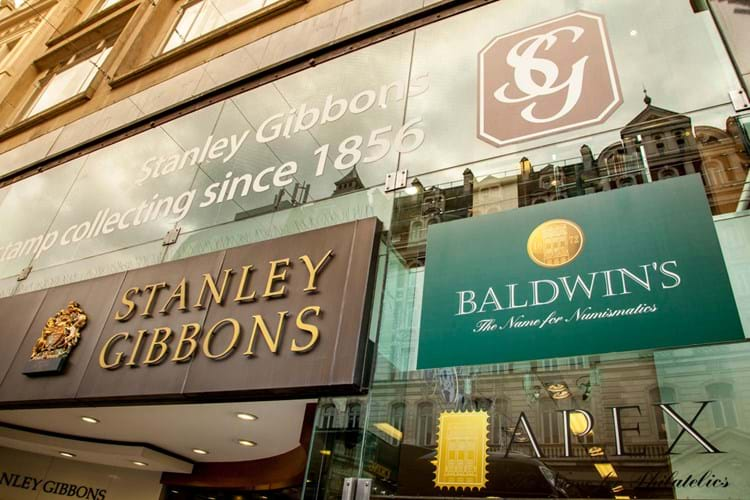

AIM-listed Stanley Gibbons Group, which runs stamp business Stanley Gibbons, coin and medal dealer Baldwin’s and auction joint venture, Baldwin’s of St James’s, has been trying to restructure since chairman Harry Wilson joined in May 2016.

It sold off a number of businesses including Dreweatts and its stake in the Masterpiece London fair.

The arrangement with Phoenix will mean the fund will take a 58.09% stake in group with a total investment of £19.45m. This includes taking on £17m of its debt from RBS.

Phoenix has separately reached agreement with the administrators of SG Guernsey to buy parts of its inventory. Investment product division SG Guernsey went into administration in November and had around £12.6m of stamp stock.

SG Guernsey's liabilities were estimated at £65m, largely relating to its controversial ‘buy-back’ investment product that the company had entered into. The scheme guaranteed customers at least 75% of the book value of their stamps at the end of a given period. The scheme, devised under former management, was not approved by the UK financial authorities and the group stopped offering these buy-backs to customers in July 2016.