Chairman Harry Wilson, who joined in May 2016, has been trying to restructure the firm and has sold off a number of subsidiaries including auction firm Dreweatts and its stake in the Masterpiece London fair to pay down debts. It raised £6m from the sale of ‘non-core businesses and assets’ and its total bank debt is currently £16.8m.

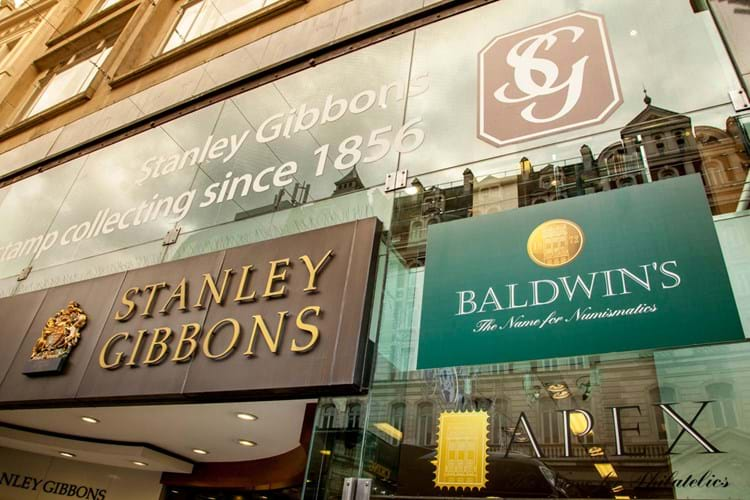

However, the company, which runs stamp business Stanley Gibbons, coin and medal dealer Baldwin’s and auction joint venture, Baldwin’s of St James's, is in talks with its lenders over its refinancing plans.

Wilson believes the company must refinance its existing debt facility before it expires in May 2018 and requires £5m to continue its restructuring plan.

He described 2017 as “another difficult year” and said the board of the company is considering raising further equity or making asset sales.

The shares fell 30% on December 29 when the results were announced.