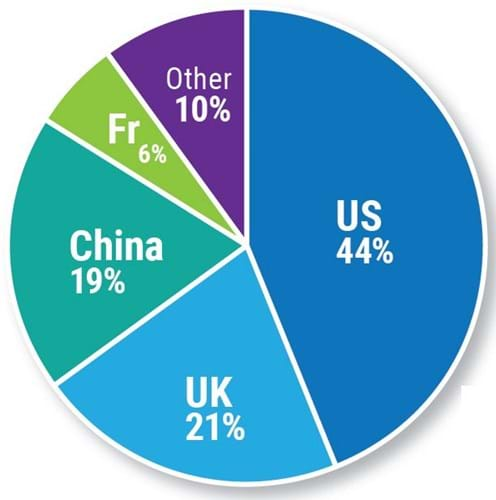

The UK reported sales up 8% to just under $14bn in 2018, leading to a 1% gain in market share to 21%. The performance helped it return to second place in the Art Basel and UBS Global Art Market Report table.

China’s market share decreased by 2% to 19%, taking third place while the US maintained its lead.

Total global art market sales reached $67.4bn, up 6% year-on-year in 2018 - the second highest level in 10 years. These three countries dominated, with combined sales accounting for 84% of the market by value.

The next largest, France, has just 6% market share and many European countries including France and Germany saw a significant slow down.

The report is compiled by founder of Arts Economics Dr Clare McAndrew using data from auction houses, dealers, collectors, fairs and experts.

McAndrew said that despite the “escalation of the Brexit crisis and widespread uncertainty, the UK had a relatively strong year of sales, while in China, a contraction in supply of high-quality works and cautious buying, as trade and debt crises loomed, led to declining values in the dominant auction sector”.

High-end growth

The growth in sales was predominantly at the high end, focused on contemporary art across sales at both auction houses and dealers. Works of art selling at prices in excess of $1m accounted for 61% of total auction values. Post-war and contemporary sales accounted for half the fine art auction market’s value, reaching $7.2bn.

It is the same story for dealers (total sales $35.9bn, up 7%) where the best-performing segment was those with turnover between $10m-50m which grew 17%, in contrast to those with turnover of $250,000 or below which dipped 18%.

Art market players are far from optimistic, despite the sold growth.

McAndrew said: "While we’ve seen another strong year of aggregate sales, the mood of the market in 2018 was generally less optimistic, as many wider economic and political issues continued to weigh heavily on sentiment.”

Online expansion

In contrast to the wider cautious outlook, the performance of online sales and the demand from so-called millennial buyers remain bright spots for the art market.

The online art and antiques market reached $6bn, up 11% year-on-year with the lower end of the market driving the growth – the majority of sales recorded were below $5000, with less than 10% of transactions reported at price points above $250,000.

New research from a survey on global Hight Net Worth Individuals (HNWI) collectors by McAndrew showed people from the millennial generation were considerably more active buyers in all sectors of the art market than older generations, with 69% having purchased fine art and 77% having purchased decorative art between 2016-18. Even in the antiques sector, which traditionally has catered to older tastes, millennial purchasing was recorded at 54%, more than double the share of baby boomers (23%).

Regarding the UK's market share, Michael Ellis, minister for arts, heritage and tourism, said he was happy that the “UK’s enduring reputation as a leading international art market has been recognised in this report”.

He added: “We are working hard to support our strong and globally competitive market, ensuring it continues to attract talent and investment from around the world.”

Fairs

The share of the total value of global dealer sales made at art fairs has grown from less than 30% in 2010 to 46% in 2018. On average, dealers took part in four fairs in 2018, down from five fairs reported in the previous two years.

Report Sources

The Hight Net Worth Individuals (HNWI) surveys were conducted by Arts Economics with UBS on more than 600 HNWIs in five different countries who had investable assets in excess of $1m, excluding real estate and business assets.

Research on the online sector was informed in part by a survey of about 70 online businesses selling art and antiques which was supplemented by a series of interviews with those working in the online art space.

For data on dealers Arts Economics used various official sources and company reports alongside an anonymous online survey of approximately 6500 dealers from the US, Europe, Asia, Africa, and South America.

For auction data financial results were used alongside a survey of the top 10

auction houses worldwide, plus a second-tier survey of just over 500 national second-tier auction houses (with a response rate of just over 20%).