However, reflecting on the past while speculating on current or future fashions, is part of what it means to be a dealer or collector.

To generate 17 predictions for 2017, Roland Arkell and Gabriel Berner sought the help of a cross-section of trade figures to forecast what we can expect in the coming months.

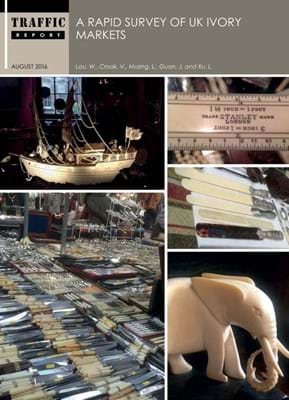

1 Ivory – the rules will change

“My main concern for the new year is the increasingly frenzied and misguided attacks on antique ivory.

Draconian regulation will only push the whole trade underground. It will be like the days of US Prohibition.”

As Paris dealer Anthony Meyer of Galerie Meyer Oceanic & Eskimo Art puts it, 2017 will be the defining year in the market for antiques made with ivory. Change will come. Second-guessing the results of the forthcoming government consultation process would be unwise, perhaps irresponsible. But, as the tone of the recent Parliamentary debate on the topic suggested, the UK antiques trade is at a disadvantage.

From the subtle removal of ivory works of art from the BBC’s Antiques Roadshowand Flog It!some years ago to the recent contribution of campaigner Hugh FearnleyWhittingstall, the trade has seldom been asked to contribute publicly to the media debate. It feels a little one-sided.

Silver dealer Michael Baggott puts it well. “The question we have asked the British people has been ‘do you want to save the elephants?’. They have not been asked ‘do you want to see items of cultural importance respected and preserved?’.”

The impact on the market and the appreciation of everything from a Georgian toothpick box to a Meiji netsuke is self-evident. Much less clear is whether the sad plight of the African elephant will be improved by curtailing the sale of objects made more than 70 years ago.

2 Price databases: the new battleground

As online price databases approach their 30th anniversary (Artnet was the first to launch digitally in 1989),price data in the art and antiques world has finally begun to show its value. This is a new front in the winning of consignments and clients.

Despite its imperfections – it is always difficult to extrapolate the fortunes of a single item to the broader market – statistical quantification can be used to reassure investors, set expectations for consignors and address the commonly held view that the art market is for insiders only. Not for nothing did Art Basel lure art market economist Clare McAndrew away from TEFAF or Sotheby’s acquire the Mei Moses Art Indices in 2016. But here’s the rub. Should the auctioneers who provide the data really be content to divulge it gratis? A case between Dallas-based Heritage Actions and Christie’s subsidiary Collectrium over the practice of ‘scraping’ data from websites is one to watch.

3 Traditional furnishings: still waiting for tastes to change

Of course the ‘buying by numbers’ is a threat to the traditional way of dealing. As Paris dealer Anthony Meyer says: “Our only weapons now are our eye and our knowledge.”

However, the impact of this on the antiques business has been a mere tremor compared to the earthquake caused by issues of supply and demand and collecting fashions.

Suggestions that the river is running dry are as old as the trade itself, but will there be a bona fide country house sale in the whole of 2017? In the UK and Ireland, at least, the odds are against it. Will the ‘soft middle’ that has troubled the trade for a decade begin to harden? This is unlikely. And will the owners of the numerous white boxes constructed in London suburbs be keen to furnish in purist period style? Perhaps a little eclecticism or ‘vintage’ is the best we can hope for.

Simon Franses, director of St James’s textile and tapestry gallery S Franses, says the gap between “material currently in demand and all the rest seems to be growing wider and until a new generation of buyers emerge that will continue. Until then there are unprecedented buying opportunities in areas that are unfashionable”

4 Exchange rates: strength in a weak pound

The silver lining in the economic gloomfest is the exchange rate – giving increased purchasing power to those holding American dollars.

While much hangs on what happens to the British economy in the year Article 50 is triggered, several dealers talk of a resurgence of interest from the US – one that Franses believes will “grow in confidence in 2017 after the Trump administration takes the reins”.

David Harvey of WR Harvey & Sons in Witney, Oxfordshire, concurs: “The devaluation of sterling has led to a flood of enquiries and sales from overseas clients both existing and new.”

Simon Phillips of Ronald Phillips says that business has “improved no end thanks to the strength of the dollar – it really is like the old days”.

5 Furniture: make a statement and mix it up

Harvey and Phillips are two of the many parties with a vested interest in removing some of the negativity that surrounds the furniture market. “I am quietly confident that the pendulum which has for some years swung against English antique furniture may now be swinging back, bringing good pieces more into vogue,” says Harvey.

The emphasis is on the ‘good’.

There are simply no longer the country hotels wishing to acquire a dozen chests or American shippers with containers to fill to envisage a ‘brown bounce’.

However, there are reasons to feel positive about the market for the small percentage of pieces that have quality, form, colour and condition to recommend them.

Piers von Til of Toad Decorative Arts is among those who anticipate a reaction to minimalism as the mid-century industrial and salvage ‘look’ becomes tired.

“Striking quality antique furniture is coming back into the frame as statement pieces to offset the high level finish of contemporary interiors. This trend is only just beginning.”

6 Demand for Chinese art: a healthy outlook

If the booming market for Chinese works of art has been checked in recent years, then expect fewer growing pains as the teenager approaches maturity.

The dwindling supply of goodquality material and a plague of confidence-sapping fakes have taken their toll. However, suggestions that an economic slowdown would occasion a market ‘correction’ have been ill-founded. The market is more focused and selective but the reaction to quality – the Pilkington collection, with its perfect storm of provenance, rarity and attractive pricing, is a case in point – suggests underlying rude health.

Encouraging too is that among the 20-something-year-old agents scouring the regional salerooms of the UK, France and Germany will be great dealers of the future.

Chinese art dealing is not without its challenges.

“The Western collector is someone we now only see in the rear-view mirror. All our buyers are based in another continent,” says Mayfair Asian art specialist John Berwald. However, a market where buyers are numbered in their thousands is the envy of all.

7 Moving up: the end of London’s passing trade

In New York, most antique dealers trade without a traditional shop front. Increasingly, it’s the same in London too. The gradual movement of the art trade from the ground level gallery to units upstairs is set to continue as rents are squeezed and the business changes.

On the move this year are big names such as SJ Phillips. Don’t be surprised if the owners go for something more modest than the current home at 139 New Bond Street.

The character of the capital’s historic art dealing streets is changing through economics, but ‘moving up’ is also an acknowledgment that the concept of ‘passing trade’ is, for many dealers, almost redundant.

Fairs have become the shop windows for the trade at a time when the traditional collector, typically a member of the professions with enough surplus income to indulge a collecting habit, is disappearing.

“With the stock at rarefied price levels this is no longer a shop-level business – it is entirely academic what floor we trade from,” says Berwald.

Business is also seasonal and in an events-led world, this isn’t going to change. “Many of us are now part of a high-class travelling circus – heavily dependent upon the auction calendar and the fairs season.”

8 Stanley Gibbons: a sticky time for stamps

If 2016 was the annus horribilis for Stanley Gibbons – one that cast a cloud over some of the best known brands in the British trade – then 2017 presents an opportunity to rebuild under new chairman Harry Wilson.

For the much-depleted staff at Baldwin’s, Dreweatts, Bloomsbury and Mallett, much will depend on whether the new board share the vision of a diversified portfolio of collectables firms that was first trumpeted when the firms were merged at a cost of £42m in 2013. It is dependent too upon the performance of the stamp market.

Few at Gibbons will have welcomed the recent BBC Radio 4 Money Box show which considered the merits of the firm’s ‘capital protected’ growth plans.

It concluded a portfolio of five stamps acquired from the company for £10,000 would be worth less than half at auction today. If the problems continue, don’t be surprised if some of the smaller vessels look to leave the mothership.

9 Specialists will flex their muscles

The departure of so many former Gibbons staffers to new firms Sovereign Rarities and Forum Auctions – and indeed the loss of key rainmakers at Sotheby’s and Christie’s in 2016 – reminded those who have forgotten that it’s talent and merchandise that ultimately counts in the art and antiques trade. These are the pillars on which brand names are built.

In a soft market for general lowmiddle end merchandise, niche specialists with ambitions beyond the research library have options.

Thanks to technology, it is easier than ever to open an auction house (a dozen joined the party in 2016) and simpler still to join as a ‘pay as you go’ consultant in a niche field.

“It all comes down to the quality of the expertise – that’s the key,” says former Sotheby’s arms and armour specialist Thomas Del Mar at the 25 Blythe Road ‘hub’ in West Kensington. New for 2017 at Blythe Road will be sales by Japanese art dealer Max Rutherston.

The independent expert is also an emerging force. The potential for conflict of interest has seen valuation departments split from auction housesin the US. The same is happening here.

Mark Littler, a former generalist at Tennants, has recently ventured down this route, providing a role that’s become scarce in a polarised market: the ‘one-stop shop’ for an estate’s solicitor or executor.

Choosing the right place to sell each item is part of the independent’s job. He says: “An increasing number of clients prefer a private sale over an auction. Their reasons range from the gulf between the sale price and the net amount they receive – quite often a 40-50% difference when both buyer and seller premiums are taken into account – to long sale and payment cycles, to just wanting to be more in control.”

10 Art finance is on an upward growth curve

“It is not a luxury to be able to borrow against your assets, it is a need.” Harco van den Oever, founder and chief executive of fine art finance firm Overstone, says the shake-up of the art lending market will begin in earnest in 2017.

Last year’s proposals made by the Law Commission to overhaul the Victorian legislation governing this field in favour of a new Goods Mortgages Act by 2019 is set to attract new faces to the market. This could include big financial institutions as well as the small specialist lenders currently operating in the UK.

Supported by an attractive legal environment, US art-secured lending has grown annually by 15-20% over the last five years, with an estimated loan book size of between $15bn-19bn (source: Deloitte Luxembourg/ ArtTactic). The UK could be wellplaced to follow suit.

Of course, not everyone has a Picasso on their walls. For the majority it is more significant that these credit streams could be available at your local auctioneer or antiques shop.

Last year, in an arrangement with lending platform Unbolted, new London firm Forum Auctions offered approved bidders the opportunity to pay for purchases with up to 90 days of interest-free finance.

Stephan Ludwig, the CEO of Forum, says the product is already extending liquidity to a wider client base. We can predict with some confidence that this market will grow.

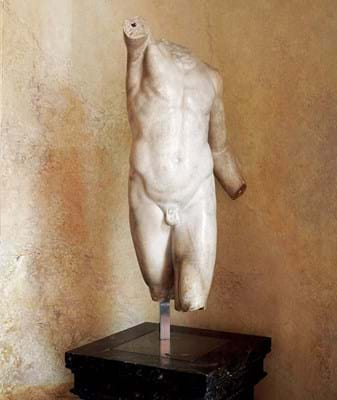

11 Antiquities: reasons to be cheerful

What the future holds for the muchmaligned antiquities trade has seldom been so debated. Yet, those in the business are determined that the future will be bright.

Madeleine Perridge, who recently left Bonhams after 10 years as head of its antiquities department to join the Kallos Gallery in Mayfair as galley director, says she is looking forward to the year ahead. “Antiquities are not going to suddenly stop being worth money,” she says. “In fact it is becoming very apparent that the opposite is true. Pieces are selling for increasingly larger sums of money because the pool is getting smaller.”

London will play an increasingly key role with the recent arrival of two new Mayfair galleries, including the Kallos Gallery in 2014, and what Perridge calls the “major boost” of Sotheby’s re-establishing its antiquities sales in the capital.

The Parliamentary process for the Cultural Property bill is likely to be concluded around Easter. The bill’s wording has raised concerns in the trade but Perridge believes its impact will be minimal. As long as they are reasonable, “any regulations that are brought in to encourage responsible collecting is a good thing”.

Above all, in an arena where an unhelpful assumptions have taken hold, the spread of an alternative narrative is key.

“Looking forward, educating people about the importance of art and its place in history will be as vital as everything else we do,” says Joanna Van Der Lande, chairman of the Antiquities Dealers Association.

12 Modern British art: strength in numbers

“If I was going to recommend a client to invest in one specific category in 2017, I’d advise them to focus on Modern British art.”

As that view from Nic McElhatton at Christie’s South Kensington shows, it was a bumper year for the top end of the Modern British art market. Artist records tumbled at the Reddihough, Bowie and Attenborough sales. Signs of overheating, perhaps?

Robert Travers of London gallery Piano Nobile is confident demand is set to continue. “This area of the market is remarkably consistent and I don’t see it as a bubble that will burst.”

He cites greater global interest in the biggest names in the sector than when the Mod Brit market surged on previous occasions. But Travers underlines his predictions with a note of caution. “At the back of one’s mind is the continuing concern about Brexit – is the economy about to hit the buffers?

13 Fakes: positives from negatives

From French furniture in Versailles to Abstract Expressionists at Knoedler, fakes brought unwelcome headlines to the art trade in 2016.

They are more than embarrassing: they sap confidence in the market. More is to come on the extent of fakery in the French furniture market – some have been decrying them for a decade – but it will be an opportunity to talk them through, decide upon their shortcomings and learn how to detect the signs.

Anthony Meyer suggests that the focus on fakes “might have a very positive impact in that collectors and dealers will get even more serious about authenticity and experts will resort to greater use of scientific means to help authenticate art works”.

Alex Bell at Sotheby’s – at the centre of a dispute over a $10m Frans Hals portrait – agrees science will play an increasing role in the attribution process. There will be ever greater scrutiny of pictures that “turn up from nowhere” with hightech research firm Orion Analytical (bought by Sotheby’s in December) at the heart of the process.

What’s new in fakery is the increasing level of sophistication, says Bell. Nevertheless, he is also confident recent revelations will not deter Old Master collectors.

“I would be surprised if that really fundamentally shakes anyone’s confidence in the market.”

14 Victorian art: look for the value

Judging by 2016, plenty of life is left in the upper reaches of the Victorian pictures market – even if it marches to an unpredictable beat.

For Victorian paintings dealer Rupert Maas of the Maas Gallery, the coming year will be mixed.

On the one hand, he says a bubble which created high prices at auction for “mediocre works by a handful of brand names” will prove unsustainable in 2017. “It’s getting out of hand, and there’s a lot of daft money involved. All bubbles must burst, so let’s hope when it happens to us it’ll be with a whimper and not with a bang.”

No-one is expecting a return to dingy oils of highland cattle and shipwrecks, but Maas is hopeful that the increased demand shown for meritorious pictures by lesser known or even unknown artists will continue.

Among the 41,000 exhibiting artists in Britain between 1880-1945, many produced works of real quality and it is these that have been making increasingly high prices. Maas says:

“That’s healthy – there is discerning money around, and that’s good for dealers.”

15 Old Masters: their demise is exaggerated

“It has been conventional to write Old Masters off as a dying area. I’m probably biased, but I really don’t see it like that,” says Bell at Sotheby’s.

Evidence of new blood coming into this market is the main cause for optimism.

“There is demand from new blood: it was a new collector who bought the [£40m] Rubens at Christie’s (see above left) and we’ve had success with buyers well outside our normal collecting area right at the top end.”

Recent dealer activity in Mayfair and St James’s, London’s traditional Old Master strongholds, is another fillip for the future. “Coll & Cortés have completely revitalised the Colnaghi brand, while other dealers such as Fabrizio Moretti and Fergus Hall have shaken things up too,” says Bell.

Archie Parker of The Parker Gallery also detects a subtle chage in taste. “I genuinely believe we have started to move away from modern minimalism and back toward classic interiors. There’s a shortage of good paintings but prices for middlemarket Old Masters are on the rise.”

16 Studio pottery progress

It was an exceptionally strong year for studio pottery with record sums paid, not just for Lucie Rie (whose flaring bowl took $170,000, or £134,000, at Phillips New York in December), but also for a group of secondary names.

Philip Smith at Mallams in Oxford witnessed a surge in demand for works by second-generation and contemporary ceramicists in the second half of 2016.

“Private buyers who are comfortable buying at auction are leading this market. They are not confined to this island – there are international clients from Japan and America. It still has some way to go.”

The focus in the decorative arts market is shifting firmly from the 19th into the 20th century.

Arts & Crafts furniture remains strong. “It is so liveable,” Smith says. However, the radical design movements of the Victorian era, such as Aestheticism, have lost their edge and the uncertainty over ivory is contributing to a softening of the Art Deco market.

Italian ‘80s design, namely the Memphis group whose wares were shown to a new audience in the David Bowie sale, is Smith’s tip for 2017.

17 End of the ‘not online’ sale

“If I’d asked customers what they wanted, they would have said a faster horse.” Had Henry Ford been around in today’s age of buzz words and corporate speak he would have been called a ‘disrupter’ – an innovator who rode roughshod through tradition.

The art and antiques trade has not yet had its Henry Ford-style disruption or, to be more current, its Uber (taxis) moment. But almost two decades after the first antiques dot-com boom, new technology has changed the way people find art and antiques, research them and bid for them at auction.

In 2017 there will scarcely be a UK ‘bricks and mortar’ auction with content that isn’t available to peruse online. Silver specialist Michael Baggott predicts that even the ‘not online’ sale – the local event that demands attendance in person – will disappear altogether within two or three years.

“There is a generation of collectors who have grown up with the digital image as their primary reference point,” Baggott says. “Some people still want to hold things but we are moving away from the hands-on ‘compare and contrast’ appreciation of what is a quality object.” This change will doubtless be subtle but enormously significant for future generations.

However, technology hasn’t seen off the time-honoured ways of selling yet. Last year’s merger of two key players, Auctionata and Paddle8, suggested that the exclusively onlineonly model is still evolving. The pair’s first collaboration, the Paddle8 Pad, aims to replicate the traditional viewing experience for a digital audience.

Launched in November, the channel provides a live video preview experience for bidders, featuring ‘shoppable stories’ from a temporary residence in a London townhouse.

Time will tell if such technological investment encourages bidding and consignments.

Successful internet commerce in other retailing spheres is based around choice, convenience and price. Even given the inherent problems of buying an object that typically needs to be seen in the flesh and seldom goes in the mail with ease, there is no reason to think it will be different for art and antiques.

But, plus ça change…

In the drive to appeal to the young private collector operating in a digital, always-on world, competitive advantage will still come down to older values.

“Great expertise, great merchandise, correct pricing, great service and great delivery – anyone who wants to survive and prosper in this highly competitive market will be primarily focused on these,” says Guy Schooling, managing director of Sworders.

Perhaps we don’t need a Henry Ford, after all.