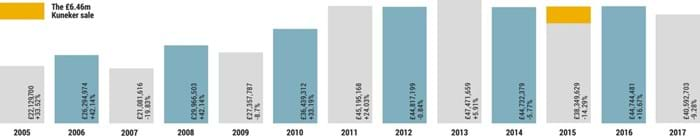

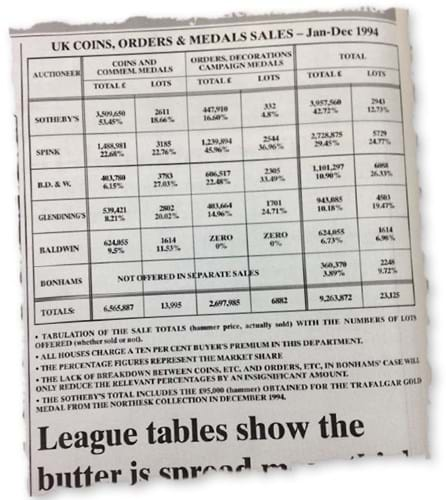

This is the 23rd year ATG has published a tabulation of London coin and medal auctions. It really doesn’t seem like a quarter of a century since 1994, when the capital’s auction take totalled £9.3m (from 23,125 lots). Tempus fugit.

Download ATG's table of London coin and medal auctions

If 2017 was not the tumultuous 12 months of 2016 – characterised by sometimes dramatic staff movements that changed the numismatic landscape – then it was perhaps the year when the consequences of those changes began to play out.

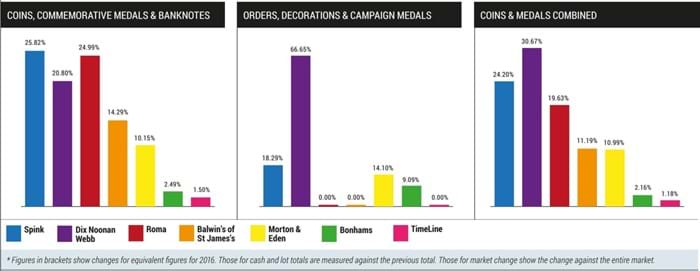

Hence, while the grand hammer total has remained more or less constant in recent years at £40m-45m*, the pecking order has changed a little.

Last year Dix Noonan Webb posted a substantial increase in its overall take (both in hammer and number of lots offered) to assume the top spot held by Spink for quite some time.

DNW perhaps gained a competitive advantage when key members of Spink staff joined the company in April 2016, but the firm is also in the strong ‘half’ of the market with its emphasis on Orders, Decorations and Medals.

There has been a significant rise on the ODM front (18.5%) and the number of lots offered (sold or not) has increased a shade under 10%. Spink doubled its OMD sales, helped by the sale of a Passchendaele VC group awarded to Corporal CF Barron, 3rd Canadian Infantry, purchased by the Canadian War Museum for Can$350,000 (£244,000).

Nimrod Dix, now executive chairman at DNW after recent restructuring (see ATG No 2327), finds the market in rude health.

“A lot of material is coming onto the market – much of it from older collectors who have decided to sell up – and almost everything is selling. Very, very few lots remain unsold, which is not something that you can say about most sectors of the antiques and collectables market. The very best items are fetching extremely high prices. We expect this trend to continue in 2018.”

This year’s table features seven auctioneers, fewer than in 2016. London Coin Galleries has become a shop window for Heritage. Wilkes & Curtis has departed the scene (although Tim Wilkes continues as a scholarly dealer in Islamic material and Matt Curtis has joined the Royal Mint) while, since January 2017, the auction element of AH Baldwin and St James’s have partnered together as Baldwin’s of St James’s.

This merger remains in a ‘settling-down’ period as Baldwin’s continued to restructure following the loss of several experts to new-kids-on-the-block Sovereign Rarities. So far Sovereign has confined its activities to higher-priced coins for sale by private treaty, but auction sales are in the pipeline this year.

Elsewhere, the classical market in London has been well served by Roma, which works mainly but not exclusively in collaboration with the Munich firm DF Grotjohann. This alliance is the practical reaction to changes in German law with reference to coins and antiquities and is very much to the benefit of London as a numismatic centre.

Despite offering significantly fewer lots, Morton & Eden has recovered by a third with a marked increase in sales of ODM while, despite a decrease, Bonhams has sold some high-priced lots and continues to obtain good results for its vendors. TimeLine sells mainly antiquities stretching into the late medieval period and its coin total is a relatively small part of its results. That said, the firm estimates an increase in coins of around a fifth.

A global market

Of course – and perhaps in contrast to 1994 – this is now a truly global market, not a national one. “Online technology is revolutionising the market making it much more global and bringing in many more bidders,” says Dix.

“A decade ago we might have had 60-80 buyers in an auction but now we have several hundred and they come from all over the world, including some countries where we never had interest in the past.”

ATG published its first tabulation of the London numismatic market in 1995, using figures from 1994.

Spink says it is a growing trend that material sourced in the UK is being offered overseas. “The market for British coins is still strong, although plateauing in some areas, but foreign buyers (US and Japan with China now on the radar screen) dominate,” says a spokesperson.

“We see more and more UK dealers buying to sell in Japan, as prices are lower in London for some of the most popular series. It is the same as for banknotes. Consignors of British collectables have followed the ‘money trail’ and were an important part of our sales in Hong Kong, New York and Tokyo (where Spink has partnered with Taisei).”

The auctioneers say this may change – perhaps as early as the second half of 2018 should the pound again find its lustre. Spink is certainly confident London remains its hub: the firm has recently invested in a deal to sponsor a gallery at the British Museum.

* ATG's tables are derived from the statistics supplied by the auction houses themselves. Two auctioneers declined to provide figures. If comparable numbers to 2016 were added – London Coins (£3.7m) and London Coin Galleries (£1.6m) – then the estimated grand total would rise above £45m.