In a US indictment centred on a Picasso painting, alleged to have been offered by London art dealer Matthew Green in a sting by an FBI agent, defendants state that the art market was suited to money laundering because it operates unchecked.

Christopher Battiscombe, director general of the Society of London Art Dealers, told ATG: “I strongly dispute the suggestion that the art trade is unregulated. Dealers are under the same obligation as other businesses to take prudent measures to prevent money laundering and to report suspicious transactions.”

Marco Forgione, chief executive of the British Antique Dealers’ Association (BADA), said that there are “more than 160 UK, European and international laws and regulations governing the British art market. These laws and regulations are in addition to those general laws and regulations affecting all businesses in the UK.”

Forgione added that “BADA has strict byelaws, breaches of which are always investigated”.

Matthew Green named

Green, 50, is a former director of the Richard Green dealership and set up Mayfair Fine Art in January 2017.

He is named alongside five other individuals and four businesses in an indictment filed by the US Attorney’s Department of Justice in New York on March 2.

The charges against the defendants include conspiracy to commit securities fraud and money-laundering conspiracy.

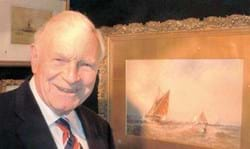

Matthew Green of Mayfair Fine Art.

‘Market that is unregulated’

Green, and the others, are named in the case relating to the attempted £6.7m sale of Picasso’s 1965 Personnages to an undercover FBI agent.

Defendant Aristos Aristodemou is reported to have described the art business as the “only market that is unregulated” ahead of this attempted sale.

Richard Donoghue, the US attorney for the Eastern District of New York, claimed the defendants committed fraud through “deceit and manipulative stock trading” and “worked to launder the fraudulent proceeds through… the art world”.

Recorded conversations

The indictment details the recorded conversations between the defendants and the undercover agent. Green is alleged to have said it was important to make more than 5% profit so that he would not be asked why he was “in the money-laundering business”.

Green, who was a director of the Richard Green art dealership until 2012, could not be reached for comment.

In a statement, Richard Green Gallery said it “is aware that charges have been made against Matthew Green in the context of his ownership of Mayfair Fine Art Limited. The Richard Green Gallery has no knowledge of, or any involvement with, the allegations but fully supports the establishment of the facts in the case.”

Rudy Capildeo, partner at law firm Boodle Hatfield, told ATG that lack of transparency in the sector has contributed to the perception of an uncontrolled market: “The sector… is protected by and required to abide by general and sector specific legislation.

“Unfortunately, the inherent tradition of confidentiality can lead to an unwillingness to be transparent, which can invite exploitation of that unwritten professional code of conduct.”

Art market speaks out on regulation

James Ratcliffe, director of recoveries and general counsel at Art Loss Register, said: “The art market is not unregulated, as these arrests demonstrate. It is notable that the comment was made by one of those arrested shortly before he was about to feel the force of that regulation. That said, there is a perception that the market is unregulated and thus a relatively soft target for those looking to carry out transactions that do not face the same scrutiny as they would in other markets.

“That perception of the art market as unregulated has perhaps arisen from the lack of consistent enforcement of current regulation across the international market, and the lack of clearly understood standards. This perception is something that the market must tackle itself if it is to avoid further headlines that focus on the Picasso, rather than the stock fraud worth ten times more.”

Rudy Capildeo, partner at law firm Boodle Hatfield, said: “It is true to say that in the UK the sector lacks a government appointed agency to monitor compliance with legislation. However… the sector… is protected by and required to abide by general and sector specific legislation.

"Unfortunately the inherent tradition of confidentiality within the sector can lead to an unwillingness to be transparent which can invite those with criminal intentions to exploit that unwritten professional code of conduct.”

Marco Forgione, chief executive of BADA, said: “BADA provides regular updates on rules and regulations to our members and works closely with Government departments to ensure that the most up to date information is available to the trade.”

Christopher Battiscombe, director general of the Society of London Art Dealers, said: “We regularly remind our members of the steps they should take to ensure they are complying with these regulations.”