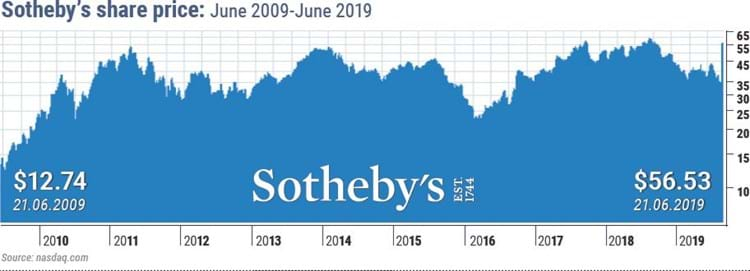

The architect of the bid for Sotheby’s can be traced back to the work of activist investor Dan Loeb and his hedge fund Third Point, which built up a 14.3% stake in the auction house over the past six years. The sale to Drahi at $57 in cash per share represents a windfall for Loeb, who first purchased shares when they traded at around $40.

Loeb aggressively pushed for change at the 275-year-old firm, describing it as “an Old Master painting in desperate need of restoration”. He gained three seats on Sotheby’s board in 2014 and a year later installed Tad Smith as chief executive to replace Bill Ruprecht.

Since 2016, the largest shareholder in Sotheby’s has been Taikang life insurance company in China, run by Chen Dongsheng. He founded the auction house China Guardian, which reportedly held a 17% stake in Sotheby’s at the time Drahi’s bid was announced.