Graeme Maxwell, whisky specialist at McTear's auction house, Glasgow

Graeme Maxwell of McTear's.

There is no question that the landscape of the whisky industry has been transformed over the past 20 years, changing from a spirit which was bought to be drunk and enjoyed to a highly tradable commodity.

The recently published Wealth Report 2019, the index compiled by Rare Whisky 101, shows an increase in value of 582% in the last 10 years for 100 of the most desirable bottles of whisky.

‘Raise a glass to whisky, the smartest place for your money’ was the headline in The Times earlier this month.

No bottle represents this meteoric rise more than the Black Bowmore 1964 bottled in 1993. When this bottle was released 26 years ago, it could have been bought from Oddbins for around £100.

At that time, when you could count the number of brands of single malt whisky available from most supermarkets or drinking establishments on two hands, this was on the expensive side for a single malt but it was still a ‘drinking’ price. Many were opened and enjoyed. In the current market a Black Bowmore in good condition will sell for around £20,000.

But like any area of investment and collectables, you have to do your research and buy the right things.

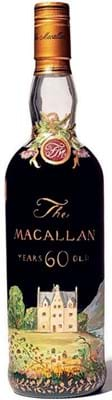

The focus of whisky collectors is primarily on single malt whiskies, which are generally produced in much smaller quantities than that of their blended counterparts. Certain brands perform better than others, with Macallan whiskies being top of the pile – famously now the £1m brand. Other high-profile distilleries such as Bowmore, Glenfiddich, and Springbank are also strong performers.

Closed distilleries

Closed distilleries are very much sought after due to the finite supplies left, particularly from Port Ellen, Brora and Rosebank.

Consider the Stromness malt distillery: established on Orkney in 1817 and one of the tiniest in Scotland at the time. It was producing only around 7000 gallons of Old Orkney Real Liqueur Whisky per year when the inhabitants voted the town ‘dry’ and the stills were mothballed in 1928. The very last bottles of ‘Double OO’ were produced in the 1930s using the remaining stocks of Stromness, making any survivors a rarity.

While there is certainly good investment potential from modern whiskies, it is not quite as strong as buying pre-2000.

This is in part due to the increased number of collectors nowadays and the swell of ‘buying for investment’ purchases that means fewer bottlings are opened and enjoyed. There’s no doubt too that the price point at retail for new limited releases has also increased.

While an increasing presence of Asian bidders for whisky at auction is evident, there is still a strong contingent of domestic, European and American bidders. With the advent of online bidding, international buyers from around the world join the flurry of bidding at McTear’s whisky auctions. However, the traditional ‘in the room’ bidders bring another element of competition to an increasingly popular market.

The UK auction market for whisky is the largest in the world and a high proportion of our buyers are Europe-based.

Mark Littler, independent antiques and whisky broker

Mark Littler, independent antiques and whisky broker.

When a single dram of whisky costs the equivalent of twice the average annual salary the media does take notice. Back to 2017 the UK auction record for a single bottle of whisky in the UK was ‘only’ £95,000 for a bottle of 62-year-old Dalmore.

The £1m sale in November of a bottle of Macallan cemented whisky’s reputation as the world’s leading alternative investment.

But has the market peaked? There are certainly signs that after a decade of double and even triple-digit appreciation things are beginning to slow down.

Another bottle of the venerable Macallan with a label design by Peter Blake was offered for sale at Bonhams sale in Edinburgh in March. It was in better condition (with a higher level) than that the auctioneers had sold last October for £700,000 so the £500,000 sale price was a little short of most expectations.

Lower down the price scale similar ‘corrections’ can be observed. For instance bottles of Macallan Royal Marriage (2011) hit their peak in October 2018 at around £3600. In February 2019 they were selling for only £2500-2600. Similarly, bottles of Macallan Coronation also reached their peak in October at around £2200. Prices have declined since, falling to an average of £1900 in December and as low as £1700 in February.

These are not just one-off prices. Specialist online whisky auctions (such as Scotch Whisky Auctions, Whisky. Auction and Whisky Auctioneer) are currently trading close to 20,000 bottles each month, their low seller's premium (often 5%) and modest buyer's premium (often 10%) sucking market share from traditional ‘bricks and mortar’ salerooms. With so many bottles sold at auction it is possible to accurately monitor the market.

So what does the future hold? Two years ago in ATG, I wrote that the whisky market had reached its peak. I guess I was two years out with my prediction.

A quick note on the recent headline that concluded ‘A third of rare Scotch whiskies tested found to be fake’.

There is no doubt it has hurt consumer confidence but the reality is that the sample size was tiny and the tests mostly focused on carbon dating early 20th century whisky rather than the later single malts that comprise 99% of the market. It is the equivalent of saying a third of all pearl necklaces are fake when tests were carried out only on pearls from the Elizabethan era.