Against an unhelpful background of political chaos and lukewarm demand in some traditional collecting areas, the market offered both the potential for spectacular individual sales and ample opportunity for new firms to make a mark.

Solid January to December hammer totals were posted by all of the major contenders who reported annual numbers to ATG, with a range of mid-table firms achieving record sums.

Woolleys on top

Woolley & Wallis held on to the top spot it has occupied for much of the past decade. Calendar year sales at the Salisbury salerooms were £17.37m. It was down on the £19.82m posted in 2018 but an increase on 2017 when the equivalent figure was £15.7m.

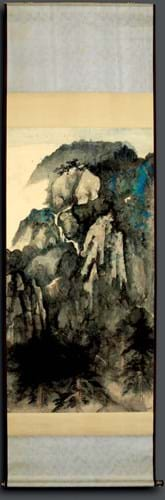

The two strongest departments were Asian art (£6m) and jewellery (£3.3m) with a top price of £2.3m bid in May for The Grand View of Chao Mountain by celebrated Chinese 20th century artist Zhang Da Qian. It was the firm’s 11th seven-figure lot and the 15th sold in any UK regional saleroom.

That national total became 16 when a large iron red, blue and white vase with a Yongzheng mark sold for £1.3m at Andrew Smith in Itchen Stoke in September.

The year was one of transition for Woolleys with the semi-retirement of former chairman Paul Viney in September and Clive Stewart-Lockhart’s decision to step down as deputy chairman in the spring. Jeremy Lamond, former director of Halls, will be joining at the end of March as head of the valuations department and associate director.

New chairman John Axford told ATG the firm had hit the ground running this year. “It’s encouraging that the first furniture sale of 2020 was the best we’ve ever had,” he said.

'The Grand View of Chao Mountain', dated February 1968, by Zhang Da Qian (1899-1983), was the top lot of the year – sold for £2.3m (plus premium) at Woolley & Wallis in May.

Back among the cream

With the second full year of trading under its belt since a change in ownership (from Stanley Gibbons to Gurr Johns in October 2017), Dreweatts’ 2019 total hammer was £14.73m. It brings the firm back among the cream of regional fine art auction houses.

The figure, reflecting sales of £13.6m at Donnington Priory and £1.1m in books and manuscripts at Bloomsbury, was more than 20% up on the 2018 of £12.11m. The top price of the year was the £290,000 bid for a Yongzheng mark and period celadon glazed ‘dragon’ vase – among the bountiful crop of Chinese art lots offered in the UK regions during November.

There had been, said managing director Jonathan Pratt, “strong performances across all the specialist departments and significant uplift in online traffic”.

Online bidders spent £5.6m in 2019 – around 38% of Dreweatts’ total sales – although Pratt stressed the importance of a saleroom environment to show items at their best.

“We are very fortunate to operate from a beautiful Georgian building positioned alongside the River Lambourn – the collections from Plaish Hall (£462,000) and Oakley House (£578,000) were both good examples of what we can achieve [here].”

In March, Dreweatts will offer the private collection of the eminent architect Sir William Whitfield (1920-2019) in a flagship two-day sale. Interior design firm Sibyl Colefax & John Fowler will present selected items from the sale in room sets in Newbury and at the firm’s London gallery.

Consolidation

The greatest change to the hierarchy in recent years has been the arrival at the top table of Chiswick Auctions.

The west London firm has morphed from a general saleroom on the periphery of the London market (sales were around £2m in 2015) to a key metropolitan player staffed by ex-CSK and other specialists.

In 2019 the firm consolidated its position with a hammer total of £14m – the same as 2018 and up from sales of £9m in 2017.

Leigh Osborne, Chiswick Auctions’ managing director, said: “The year has seen some great results in our specialist sales [including a house record of £370,000 for a 10.51ct Burmese ruby and diamond ring] but we are also delighted with the popularity of our interiors sales. A range of themed sales are planned for this year [the first titled From the Curious to the Extraordinary was held in January], so that we can cover broader interests and offer something for everyone.”

Tennants offered 80 sales and sold almost 40,000 lots in 2019, culminating in a solid hammer total of £11.8m. The figure was down on 2018 (£13.3m) when the North Yorkshire firm sold more six-figure lots. Single-owner private collections provided the firm with its best moments in 2019: the top price of the year was for a 1970s Rolex Daytona ‘Big Red’ sold for £120,000.

Capital expansion

In 2019 the 38 auctions conducted by Lyon & Turnbull totalled a hammer of £11.5m, almost £1m up on the previous year (£10.65m).

The firm benefited from continued growth in London, with two new sale formats: The Classic Tradition offering traditional pictures and the two Modern Made catalogues, the first at the Mall Galleries in the spring including a record £200,000 for Growth 1, 1968 by Malaysian Modernist Abdul Latiff Mohidin (b.1938). The highest price for the year at the Edinburgh headquarters was £130,000 for a first-edition Charles Darwin’s On the Origin of Species in October.

“Since we opened our gallery and offices on Connaught Street in 2017, London sales have grown steadily and now stand at eight per year and we are looking to grow them further,” managing director Gavin Strang told ATG. He added that the firm had also completed some notable private sales.

“A highlight was an important Islamic textile that we sold to an American museum on behalf of a UK-based collector.”

At Sworders in Stansted Mountfitchet chairman Guy Schooling said his firm’s turnover was £9.5m – “up on last year [£9m] and an excellent result bearing in mind we held the £1.75m North Mymms Park auction in 2018”.

In a year when the business opened a viewing and consignment office in London’s Cecil Court, the highpoints were provided by two single-owner sales (the Barbara Holiday collection from Cumbria in January and the contents of Alderley House, Gloucestershire, in July) plus six-figure contributions from a Cedric Morris oil (£160,000) and the ‘charity shop’ Qianlong wall vase (a house record of £380,000).

“It will be a tough act to follow,” said Schooling.

“However, we were joined at the end of the year by two seasoned, experienced and proven business getters, Luke Macdonald and Stephen Giles. We are sure they will provide much additional income.”

Brexit effects

In Dublin, Adam’s managing director James O’Halloran said the market had been tempered by the political chaos and cautious spending that marked the Brexit process.

“The ‘B’ word was on everyone’s mind in Ireland during 2019. Now that some clarity has been brought to the situation, we have some hope that confidence will increase in the art, jewellery and antiques markets here.”

He said 2019 was little different in real terms on the 2018 results with turnover from 20 auctions and 4500 lots increasing marginally to €12m (up from €11.6m). Jewellery and Irish paintings blanket-covered all of the firm’s top 20 prices in 2019 although ‘At Home’ auctions of traditional antiques and collectables and ‘Mid Century Modern’ auctions of Contemporary art and Mid-century furniture are among the most popular events at the St Stephen’s Green salerooms.

Fellow Dublin firm Whyte’s enjoyed a share of the city’s showpiece sale in 2019 with the Ernie O’Malley collection (held in association with Christie’s in November) bringing a premium-inclusive €5.42m led by Reverie, a 1931 Jack Yeats oil sold for a record €1.4m (£1.2m).

Market movers

Some subtle changes to the status quo can be found in the rise of relative newcomers such as Hannam’s in Selborne, Hampshire (which reported a 22% increase year-on-year to £4.8m), and jewellery specialist Elmwood’s in Notting Hill (up 363% to £5.1m – see above left).

There were also outstanding years for some long-established ‘mid-table’ firms.

Reeman Dansie in Colchester is celebrating its most successful year of sales in the firm’s 138-year history with hammer figures of £4.8m. “We found that market conditions in 2019 were surprisingly buoyant,” said managing director James Grinter.

The firm enjoyed a sensational sale in September courtesy of a £600,000 collection of approximately 300 unframed antiquarian maps of the Philippines and Far East. An early edition of the map of Philippines by Murillo Velarde, dated 1734, set a new house record of £260,000.

This year, to augment its six Fine Art sales and quarterly Collectors’ sales, the firm will hold Homes & Interiors auctions where estimates will typically range from £30-250.

“With increased concern for unnecessary consumption of our planet’s resources, auctions can play a key role in the battle against the throw-away society,” said Grinter. “Reeman Dansie is justly proud to have been recycling for 138 years.”

The Dominic Winter auction house in South Cerney, Gloucestershire, reported its “best calendar year to date, with a hammer total of just over £5.5m, up 17% on what had been a brilliant 2018”.

The highpoint of the year for the books and memorabilia specialist firm was the extraordinary library of the bookseller Martin Orskey which hammered £750,000 across 440 lots. This helped the average lot hammer price across the year jump from £480 in 2018 to £660 in 2019.

Senior valuer Chris Albury told ATG: “The coming year looks equally positive. I expect the steep price increases to continue for the crème de la crème, and for unique items with compelling associations.”

Ewbank’s marked 30 years in business with its highest-ever annual sales total of £3.7m.

“Brexit uncertainty undoubtedly dampened the market so the small rise on our £3.6m total for 2018 was a remarkable achievement,” said chairman Chris Ewbank, who launched the business in 1990.

“The most spectacular success has been with our entertainment and sports memorabilia department, which registered over £1m and, after quite a short period, has now taken over as our leading department.”

The Surrey firm is planning to add several timed auctions to the schedule for 2020, the first being coins in March. Already 50-60% of items routinely sell to online bidders.

Old-fashioned values

Richard Winterton of Lichfield had broken through the £2m barrier for the first time in 2018 (up 33% on 2017). In 2019 the firm posted £2.4m – a further increase of 21%.

It came without a big-ticket item and a difficult market for traditional chatells.

“In that figure there was no show-stopper, just plenty of good old-fashioned basic auctioneering,” said Winterton.

The firm is in the early stages of plans to add another three salerooms to its current auction complex, increasing space by around a third.

In north-west England, sales at Adam Partridge totalled £3.5m (down from a record £4m in 2018). The aggregate from two salerooms in Macclesfield (£2.71) and Liverpool (£0.78m) came without the ‘windfall’ lots that had helped figures in recent years and meant that the firm held its market share in the region where Knutsford auction house Wright Marshall ceased trading in August.

Partridge looked at acquiring the fine art tranche of that business but opted instead to launch a new venture further up the M6 in Catterall. Small specialist sales are planned there this year with furniture and other items sent for sale in Macclesfield and Liverpool.

Elmwood’s: a rapid riser

London boutique saleroom Elmwood’s raced up the standings in 2019 with jewellery sales totalling £5.1m – up from £1.1m in 2018. Begun as a one-man-band by ex-Chiswick specialist Samuel Hill in 2017, the Notting Hill firm has won business – perhaps at the expense of more established auction houses – with a bespoke, end-to-end service and aggressive margins.

With ‘best in class’ gemstones remaining an area of strength, a quartet of five-figure sales in 2019 included a house record £140,000 in July for a 9.46ct Kashmir sapphire ring.

From modest beginnings two and a half years ago, Elmwood’s now employs nine staff including chief business-getter Adam Johnson, newly promoted associate director Beth Dawson and recent recruit Rene Dub, formerly a jewellery specialist at Christie’s and Phillips in Geneva.

In late February they will leave the current office at Munro Mews for a new gallery on Talbot Road – a 2000 sq ft space that will allow for full pre-sale viewings. Auctions will continue to be held ‘live’ but without a traditional saleroom environment: bidders are instead invited to bid via phone, on commission or via internet platforms.

Around 12 sales are planned for the year, with the first of two select events scheduled for March.

Athelhampton and Asian art boost for Duke’s

On the back of a new programme of auctions, 2019 proved to be a record year for Duke’s of Dorchester.

Although a January to December figure was not available at the time of going to press, sale revenues in the final quarter of the year alone were £5.63m.

The contents of Athelhampton House were followed by a stellar Asian art sale that included both the collection of local connoisseur Anthony du Boulay and the Qianlong celadon and enamel teapot, sold at £800,000.

Partner Guy Schwinge described the positive reaction to the Athelhampton sale as a “good news story for furniture”.

He added: “We sense an upturn in traditional collecting areas now we have clarity on Brexit and a government with a majority. How Brexit plays out is another issue entirely.”

Like many other auction houses, Duke’s reports pressure on margins with fierce competition meaning minimal vendor’s commission for the best consignments.

Forum and Fellows: making the most of online bidding

Based in Battersea, Forum Auctions recorded sales of £9.81m – a year-on-year growth of 15% (up from £8.47m in 2018). Of this, £5.1m were books, maps and manuscripts, £4.2m were prints and editions with £0.52m of wine completing the total.

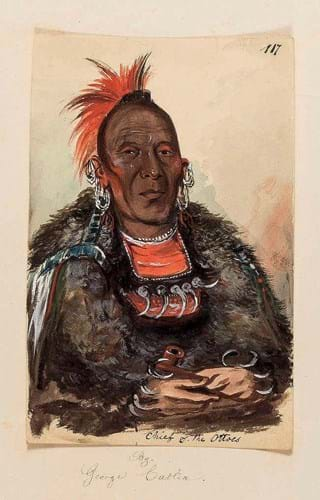

Top lots included the £172,000 sale of previously unknown letters, prints, drawings and watercolours of Native American subjects by George Catlin in March and the Banksy numbered edition Girl with Balloon sold in December at £120,000.

The focus in 2020 is on selling more lots online. According to CEO and founder Stephan Ludwig: “Of the 11,000 lots we offered for sale in 2019 fewer than 500 were hammered down to a bidder’s paddle ‘in the room’.

“While we of course warmly welcome clients to attend our auctions, it has been clear for some time that our future growth is inextricably tied into accessing new collectors from the increasingly e-commerce-savvy global shopper community.”

During 2019 timed auctions hammered £1.59m which represented 17% of overall sales and almost 20% of overall commission revenues. Forum projects that the 50 timed auctions it intends to hold this year will represent more than a quarter of overall sales, hammering over £2.5m.

'Wah-ro-néesah, The Surrounder, Chief of the [Otoe] Tribe', a c.1832 watercolour by George Catlin – £89,000 (plus premium) at Forum Auctions.

At jewellery and watches specialist auction house Fellows, timed online sales are similarly important.

Stephen Whittaker, managing director, said 2019 was “another progressive year at Fellows, from the introduction of our own live-bidding platform to the success of our online timed auctions which have gone from strength to strength.

“We are continuing to thrive in the ever-changing modern climate and we are hopeful that we can build on these successes in 2020. Our first flagship watch and jewellery auctions of the year will hopefully set a positive precedent for the following months.”

Fellows is also differentiating its service by offering free postage on its major sales, an initiative it began last year and which it has decided to extend into 2020.

ATG’s annual round-up of regional auction houses’ activity provides a snapshot of market conditions and performance at a sample of firms based on the hammer totals they report to us. The term ‘regional’ (or ‘provincial’) auction houses is used to draw a distinction between the majority of UK and Irish art and antiques auction houses and the ‘London big four’ (Christie’s, Sotheby’s, Bonhams and Phillips). Totals reported to us after deadline will be added to this article online.