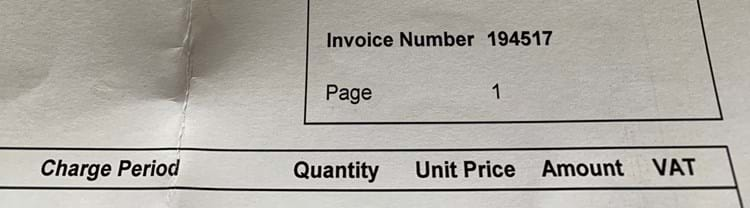

The government held a consultation on the issue in the spring (ending May 20) and has now announced it will withdraw the VAT Retail Export Scheme (VAT RES) from January 1, 2021 when the UK leaves the European Union.

Trade bodies across the art, antiques and retail business sectors are lobbying the government to stop the move.

Nigel Talbot of London dealership Grosvenor Prints said: “The withdrawal of this scheme will have a dramatic effect on overseas buyers, US buyers in particular, who will look at having to pay tax to a foreign country as a kick in the teeth.

“About 20% of our business at Grosvenor Prints is with America and we don’t want to do anything to harm it. The government strategy is to make short-term money but it could ultimately deter foreign tourists coming to the UK. Instead they will spend in the EU cities which still offer the scheme.”

If the government’s plan goes ahead, next year overseas visitors will still be entitled to VAT-free shopping for items purchased in store, but only if they also have the items delivered to their overseas addresses and pay the appropriate import/export duties and charges.

So far the change will not extend to Northern Ireland but this could change depending on the Brexit Withdrawal Agreement treaty.